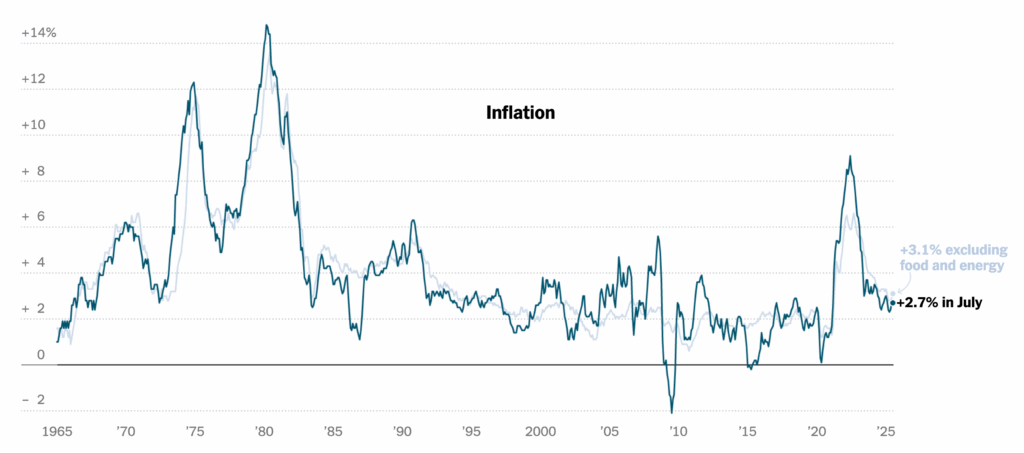

The most recent CPI (inflation) report

- July 2025 CPI: +0.2% m/m; +2.7% y/y.

- Core CPI: +0.3% m/m; +3.1% y/y.

Source: BLS news release for July 2025.

Unemployment Rate(latest)

- U-3 unemployment rate: 4.2% in July 2025. Job gains concentrated in health care/social assistance.

What this implies for the next Fed meeting

- Next FOMC meeting: Sept 16–17, 2025.

- Markets are leaning toward a 25 bp cut in September after the July CPI/Jobs data (futures-implied odds ~85–90% as of today).

My read: With headline inflation at 2.7% and unemployment up to 4.2%, the risk balance is tilting toward a small “insurance” cut (25 bp) in September—unless August jobs or PCE re-accelerate. Core at 3.1% keeps them cautious; a larger cut would likely require a materially weaker August labor print or tightening financial conditions.

“Side money” in money market funds

- Total MMF assets: ~$7.15 trillion (week ended Aug 6, 2025).

How to think about it: Not all of that is “waiting to buy stocks”—a big chunk is institutional cash management. But rate cuts reduce MMF yields, which often nudges some cash toward risk assets (equities, IG/ HY credit) at the margin. Scale-wise, even a small rotation of that base can move markets.

Weaker dollar—effects on stocks, economy, hiring, and politics

State of play: The U.S. dollar index (DXY) had one of its worst first halves in decades (≈10–11% drop), though it’s had brief rebounds.

Stocks

- Tailwind for multinationals: Foreign sales translate into more USD revenue/earnings when the dollar is weak; recent coverage highlights this effect. Beneficiaries: mega-cap tech with overseas sales, global industrials, consumer staples/luxury. Headwind: import-reliant small/mid caps.

Inflation & the economy

- Import prices: A weaker dollar raises import costs, adding mild upward pressure on inflation (partly offset this year by goods disinflation and energy).

- Tariffs interplay: Fed researchers find limited immediate pass-through before tariffs, with effects accruing after implementation—so dollar weakness + tariffs could keep some price pressure sticky into H2.

- Trade/production: Dollar depreciations historically support export-oriented output and employment at the margin.

Hiring

- Export-exposed sectors (manufacturing, certain services) can see relative hiring support; import-heavy sectors may see margin pressure and slower hiring if they can’t pass costs through.

Politics

- A soft dollar + tariffs = higher import costs → political focus on inflation at the checkout, pressure on the Fed to cut, and debate over trade policy. Recent commentary frames weak-dollar periods as amplifying tariff-linked inflation risks.

Bottom line

- Inflation: cooling enough (2.7% headline) to allow a 25 bp September cut, but core 3.1% keeps it one-and-done for now unless labor weakens further.

- Jobs: 4.2% unemployment signals easing labor tightness, reinforcing a small cut.

- Cash on sidelines: ~$7.15T in MMFs; if the Fed starts cutting, expect some rotation into risk over Q4, not a flood.

- Dollar: Continued softness would help multinationals, nudge inflation via imports, and keep policy debates hot.